The South African 2024 Elections and the possible outcomes.

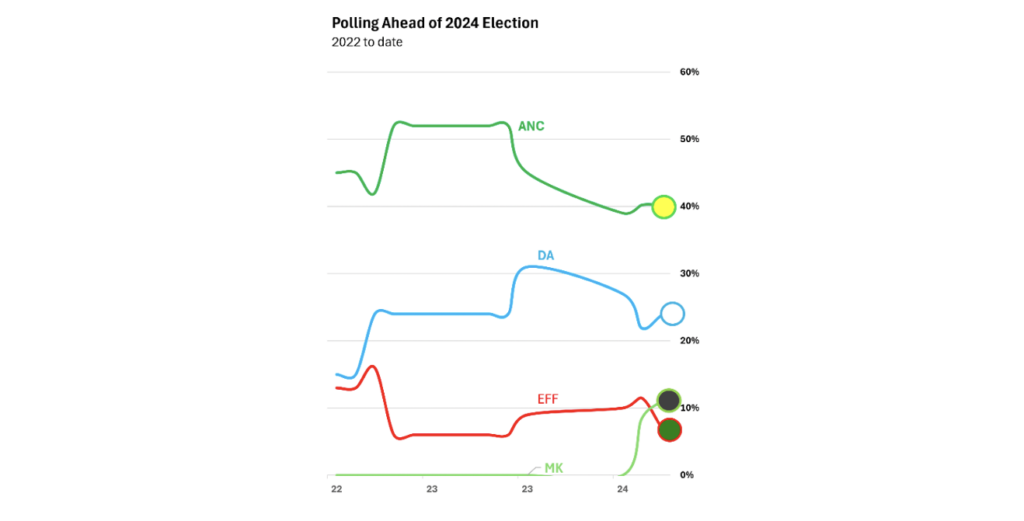

This week, South Africans will visit voting stations across the country in what will likely be the most historic election since 1994. Support for the ruling party has been in perpetual decline and there is no confusion as to why this is the case, the economy has simply been mismanaged to such an extent that the ANC itself has started to turn to the private sector to lend a hand (about the least popular option for a party who has strong ties to communism). This shows just how desperate they are, as does their recent move to introduce NHI which so far appears to have backfired (according to polling data).

Heading into Wednesday’s election, there is a very high probability that the ANC will lose it’s majority, but the real question is who will the ANC be forced to partner with – on the upside, the IFP, DA and other smaller parties, or on the downside, with the far left EFF/MK. Fears of the latter outcome are portrayed as having an equal chance to that of the former but in reality most political analysts are of the view that such scenarios are highly unlikely.

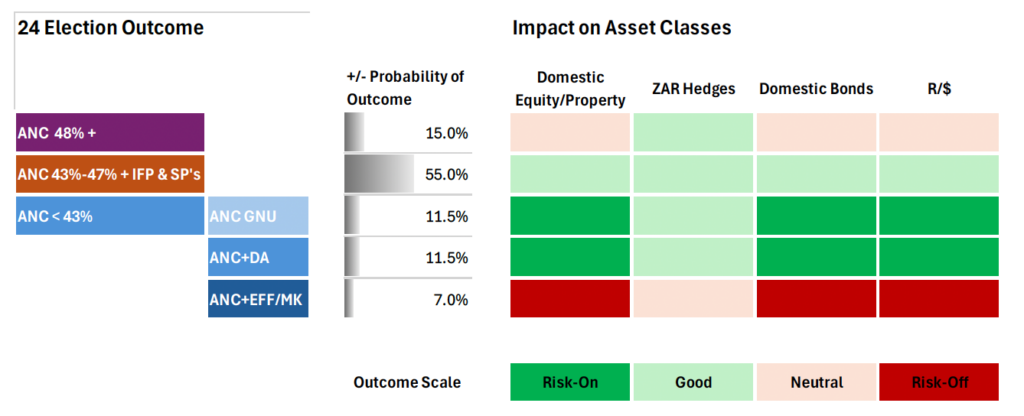

On the one hand an ANC achieving between 43% and 47%, and being forced into a collation with smaller parties like the IFP and other minority parties, is likely to be the most certain outcome. Philosophically their ideals are a good match, and the polls suggests it’s a likely possibility, Hence this being the most likely outcome which analysts assign a 55% probability to.

If the ANC fails to garner more than 43% of the vote, it will force one of three things a) form a collation with the DA, b) call for a government of national unity (GNU) or c) form a collation with the EFF or newly formed MK party. While there are elements of the ANC that would suggest that they could get into bed with the EFF/MK, it would ultimately risk becoming a purely rural party as its urbanised voter base would likely turn to more center orientated parties – a risk that is already becoming a reality in many respects. Signs that the ruling party have already turned to the private sector for help suggests that working with the EFF/MK (who most certainly wouldn’t think of asking “WMC” for help) is highly unlikely. To this scenario analysts assign a mere 7% probability.

The most positive scenarios for domestic asset classes would be co-operation between the ANC and the DA, or the call for a Government of National Unity by the ANC. GNU’s are typically formed in periods of war or other periods of unrest. The probability of either of these two scenarios seems remote but less remote than a disastrous ANC/EFF/MK partnership. Importantly, any such outcome would have dramatic consequences for domestic asset classes, including the ZAR.

FUN FACT:

The interim constitution negotiated by the multi-party negotiations to end apartheid that started in 1990 allowed all parties that gained more than 10% of the vote to participate in a Government of National Unity.

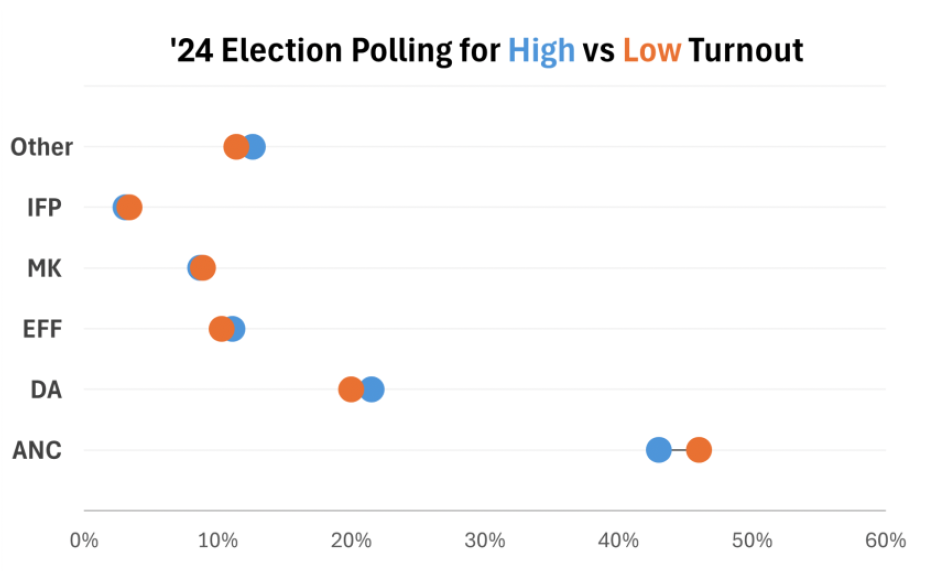

Voter turnout could be a meaningful factor in the election, at least for the ANC which naturally performs terribly when voter turnout is higher. This is less of a factor for the smaller parties, although they do tend to do worse when the turnout is low.

For the rural vote, those parties concerned will be closely watching the weather which is often a reason to not show up on voting day.

From an investment perspective we’ve already discussed the scenarios in which domestic asset classes will perform well (see the second chart above), but it’s worth reflecting on the risk to the upside. Foreigners are largely absent in our equity and bond market, at least compared to what they used to be. To compound this, locals are underinvested in local risk assets thanks to attractive short dated fixed interest returns. In a very positive election outcome, patient investors (the kind who have an appreciation of undervalued assets) stand to benefit as money tries to come back in the (now narrower) door.

We don’t argue with the case for the compulsory savings industry’s shift to invest more globally, but the rush to do so at a political crossroads is quite surprising. The average foreign exposure of the ASISA SA MA High Equity category at the end of the last quarter stood at 42%, where 45% is the limit. While local equity sentiment leans more negatively, there are clear opportunities in the fixed income space, highlighted by foreign investment flows and a strengthening of the rand. We would caution investors to be concerned about the most obvious risks, very few investors have been caught off guard by the risks that everyone was aware of.

On the balance of it our equity and hedge managers typically hold more ZAR hedge exposure in their portfolios for a few reasons: firstly, the local bourse is dominated by companies who derive a large portion of their revenue in hard currency e.g. British American Tobacco, Richemont, Naspers/Prosus, and the miners. Secondly from a liquidity perspective a positive outcome in the election would see major index flows to SA, which would disproportionately flow to the rand hedges.

Lastly, in a poor scenario these would certainly hold up better than true domestic companies, such as banks, insurers, and retailers. They do however have enough exposure to make a difference in a best-case scenario simply because the upside magnitude of the domestics is that much greater because there is so much bad news priced in. For example some of the more aggressive local equity managers in our portfolios have as much as 50% in domestic exposure (of their local equity exposure) the average fluctuates around 30%.

The world will be watching on May 29th and ratings agencies like the S&P echo the sentiment of the global investment community, “while the investors have been cautious on SA, more political and policy stability could lead to increased investment activity”.

While there are many uncertainties in this election (as there are with any), we would emphasise the importance of controlling the risks we have control over – ourselves.

- Don’t read too much into the noise until there is an actual result.

- Avoid trading unless it is necessary given the heightened level of volatility and elevated cost baked into spreads.

- Keep in mind that it may take weeks for coalitions to form, new cabinets to be elected etc.

- In the short-term politics may move FX, bond, and equity markets, but in the long-term global factors dominate.

- Keep in mind that our democracy works and the loss of support for the ANC is proof of that.

Information Courtesy of John Haslett from Graphite Asset Advisory and interpreted by RockWealth Capital.